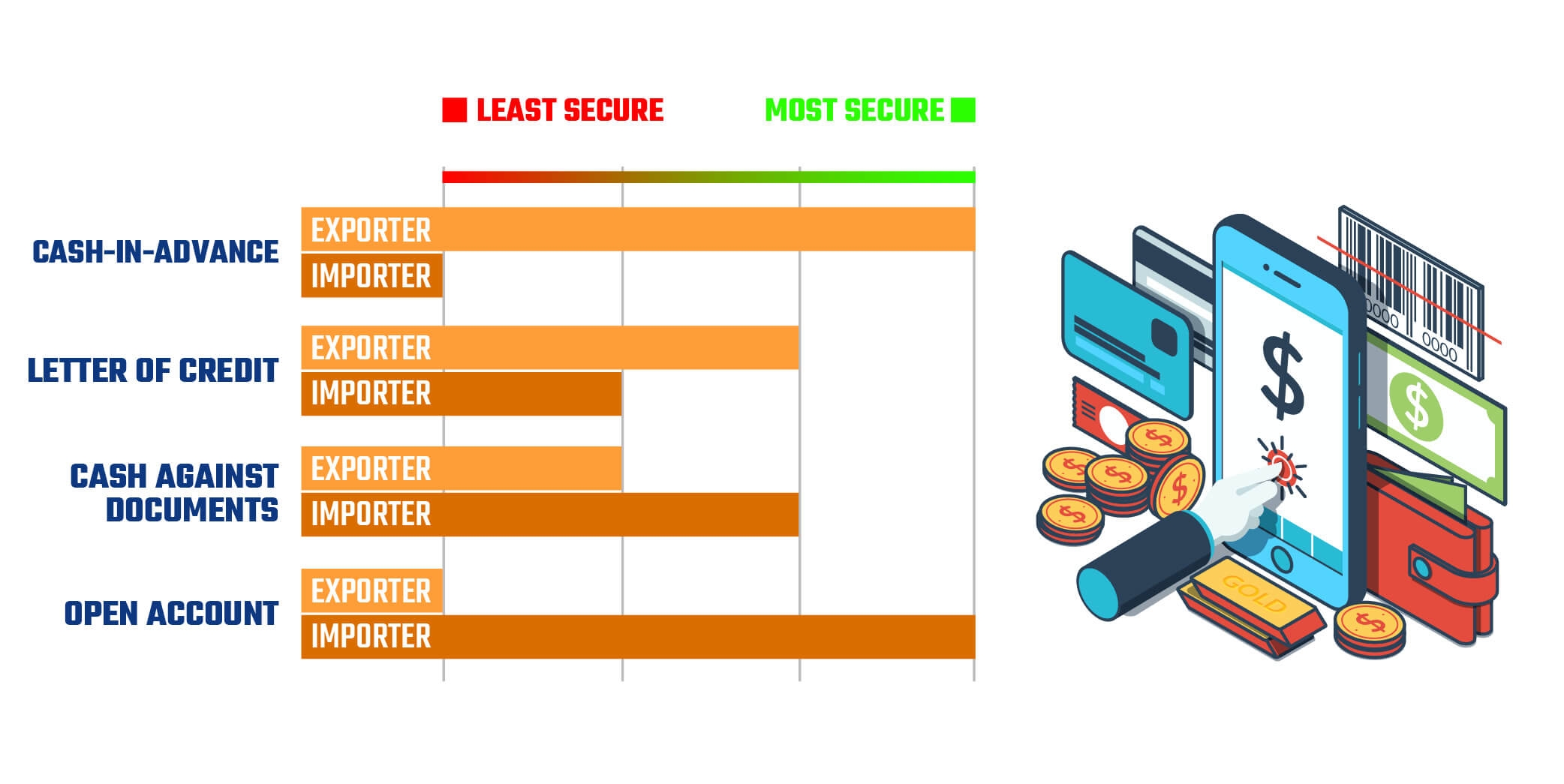

There

are various payment methods in foreign trade, and payment methods that are

issued by letter of credit are one of the safest methods. For detailed

information about these payment methods, you can reach our article titled Payment

Methods Used in Export and Import, published by Trade Atlas.

Payment methods made with letters of credit are frequently preferred by

companies dealing with foreign trade.

What

is a Letter of Credit?

A

letter of credit is a payment mechanism used in international trade to provide

an economic guarantee from a creditworthy bank to an exporter of goods. To

elaborate; The companies that export and import will make an agreement between

them based on payment by letter of credit, then the importer goes to his own

bank, that is, the issuing bank, and instructs the exporter to open a letter of

credit.

1.

First of all, the exporting and importing parties make an agreement between themselves

regarding payment by letter of credit.

2.

Next, the importer goes to his own bank, that is, the issuing bank, and

instructs the issuing bank to open a letter of credit in favor of the exporter.

3.

The issuing bank notifies the exporter's bank, namely the correspondent bank,

that a letter of credit has been opened.

4.

At this stage, the exporter's bank informs the exporter that a letter of credit

has been opened in favor of the exporter.

5.

The exporting company sends the goods to the importer.

6.

In this step, the exporter delivers the shipping document to the correspondent

bank and receives the money for the goods sent in return.

7.

The correspondent bank gives the shipping document to the importer's bank and

the issuing bank (importer's bank) makes the payment to the correspondent bank.

8.

The issuing bank gives the shipping document to the importer and the importer

makes the payment to the issuing bank.

9.

Finally, the importer receives the goods from the customs with the shipping

document.

What

are the Types of Letters of Credit?

1.

Revocable Letter of Credit: In

this type of letter of credit, the importer has the authority to go and remove

the letter of credit at his own will without asking the exporter. It is not a

preferred method because it is not a reliable method.

2.

Irrevocable Letter

of Credit: This type of letter of credit cannot be canceled or changed

without the mutual consent of the parties. To withdraw or cancel, the consent

of all parties is required.

3.

Unconfirmed Letter of Credit: In this type of letter of credit, the

correspondent bank does not assume any financial responsibility. It is

sufficient only to inform the beneficiary that the letter of credit has been

opened and inform about the conditions of the letter of credit.

4.

Confirmed Letter of Credit: Contrary to the unconfirmed letter of

credit, it is confirmed by the correspondent bank and an additional guarantee

is given that the price of the goods will be paid. If the buyer notifies the

seller by attaching a bank confirmation, it means that the bank that issued the

letter of credit assumes all responsibility.

5.

Revolving Letter of Credit: These are letters of credit that are not

invalidated once used. If there is a continuous purchase and sale agreement

between the importer and the exporter, a single letter of credit is opened to

cover the shipment to be made within the agreed period, instead of opening a

separate letter of credit for each shipment.

6.

Red Clause Letter of Credit: It is a type of letter of credit stating

that a prepayment will be made to be used in the processing, packaging,

transportation, or storage processes of the goods specified in red and included

in the document of the letter of credit.

7.

Green Clause Letter of Credit: It is a type of letter of credit that

allows the importer to be paid in advance. It is made against invoices and

receipts showing the various payments made or the state of the goods as they

are stored.

8.

Back to Back Letter of Credit: It consists of two different letter of

credit transactions that are independent of each other. It is a payment method

that takes place in the form of a letter of credit in which the beneficiary of

the first letter of credit is the supervisor of the second letter of credit.

9.

Transferable Letter of Credit: It is the type of transaction that

enables the liability of beneficiary to be transferred to another beneficiary.

This transfer can only be made once.

10.

Stand-by Letter of Credit: It is a type of letter of credit that acts

like a letter of guarantee. It includes a service, not a good. It is used to

guarantee the service.

Trade Atlas is a global importer and exporter

search engine that contains 1.5 billion bills of lading and shipment data of

17.5 million importer companies in more than 230 countries around the world.

Trade Atlas is with you to accompany you in taking steps towards becoming a

more important part of global trade! To be a part of the global ecosystem, you

can register and search for free by clicking here.