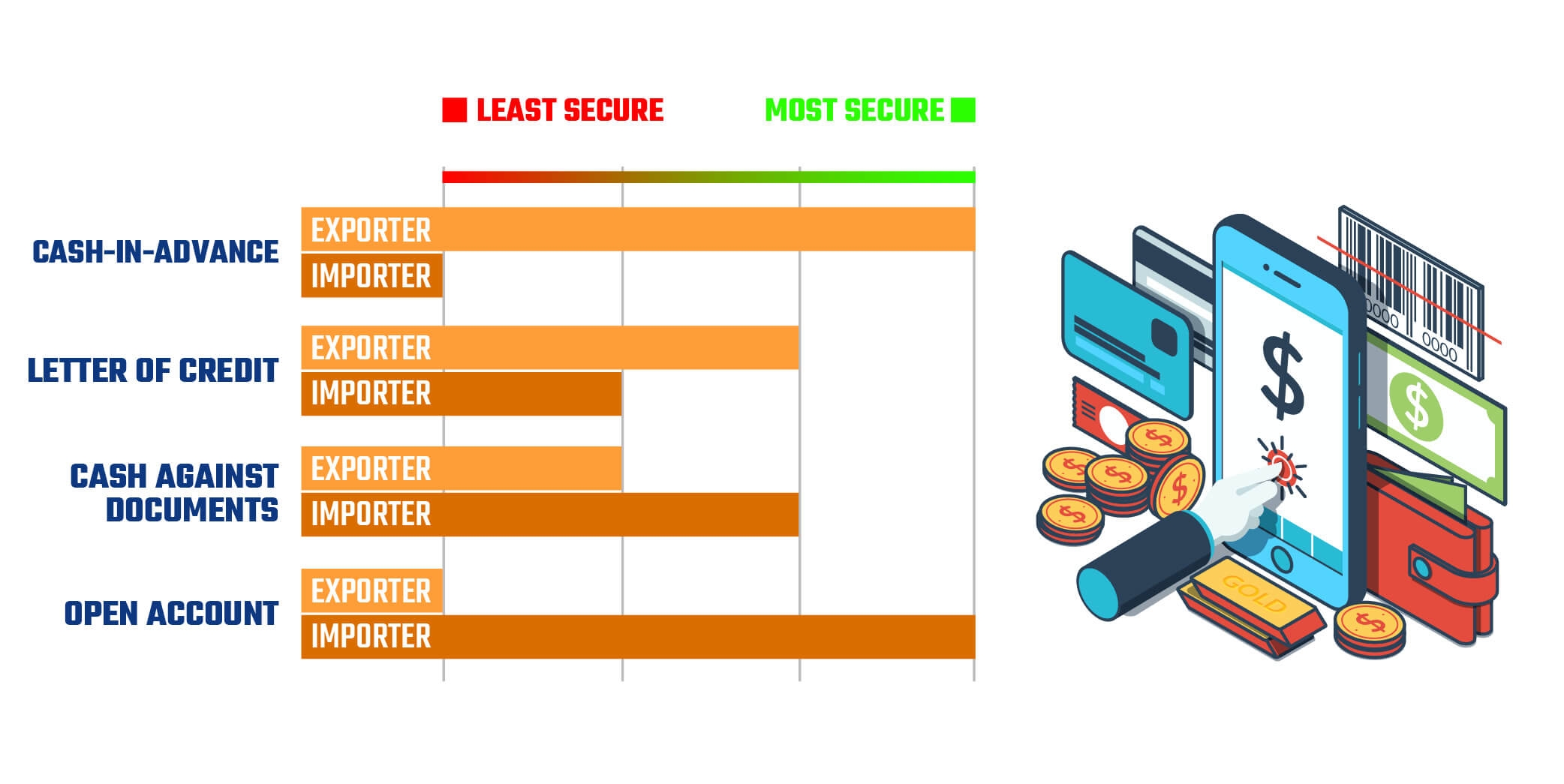

When choosing one of the payment methods used in foreign trade, it is important that the risk is kept to a minimum and mutual benefit can be achieved by both the exporter and the importer. The most frequently used payment methods are cash-in-advance, letter of credit, documentary collections and open account.

1. Cash-in-Advance

In this payment method, the exporter receives the payment before the goods are delivered to the importer. In this way, the risk of the exporter company is kept to a minimum. While it is the most beneficial and risk-free method for the exporter, it is the most risky one for the importing company.

2. Letter of Credit

In the letter of credit payment method, the payment is guaranteed to the exporter by a bank on behalf of the buyer. The exporter company is entitled to receive the payment if it fulfills the terms and conditions specified in the letter of credit. It is seen as one of the most reliable payment methods used in international trade. In this method, which benefits both the buyer and the seller, the exporter is assured that the payment will be made in full and on time, while at the same time, the importer is protected because the payment is not realized when the conditions are not met.

3. Cash Against Documents

In this payment method, after the exporter delivers the goods, he gives the documents needed by the importer to his bank for collection, and the bank delivers the documents to the importer in return for the importer's payment or acceptance.

4. Open Account

Open account is also called "cash against goods". The cost of exported goods is paid after the importer takes delivery. While it is the safest payment method for the importer, it is the most risky method for the exporter.

Figure 2. Turkey’s Foreign Trade By Type of Payment (2019) Source: TUIK

When we look at Turkey's foreign trade by type of payment, according to TUIK 2019 foreign trade data, in both imports and exports for by far the most widely used method of payment is open account(cash against goods).Open account, which is considered to be the most risky payment method especially for the exporter, carries significant risks in terms of full and timely payment. However, the fact that this method is frequently preferred while in the position of an importer provides a great advantage.

Cash-in-advance, the second most preferred method, is the safest payment method for the exporter, but it is the most risky for the importer.

Contrary to popular belief, the percentage of use of the letter of creditpayment method, which has almost equal risks for both parties, remains at very low levels with 6% in exports and 2% in imports.

Figure 3. Exports By Type of Payment (2019) Source: TUIK, T.R. Seoul Embassy, Trade Undersecretariat

Looking at both import and export figures in 2019, South Korea is in the top 10.There is a huge difference between South Korea and Turkey when we compare their use of payment methods in exports. While South Korea prefers the safest payment method for the exporter called cash-in-advance with 59%, Turkey prefers the most risky one which is cash against goods with 66%. In addition, while South Korea also uses consignment and documents with acceptance credit payment methods, the use of these methods is close to zero in Turkey.

Figure 4. Imports By Type of Payment (2019) Source: TUIK, T.R. Seoul Embassy, Trade Undersecretariat

When we look at imports by type of payments, while Turkey prefersthe safest payment method for the importer called cash against goods with 62%, South Korea prefers the most risky payment method for the importer which is cash-in-advance with 65%. As in exports, the use of consignment and documents with acceptance credit payment methods is close to zero in Turkey.

The letter of creditpayment method, on the other hand, does not comply with the common belief in South Korea and remains at low levels of 5% in exports and 6% in imports.

When the ICC's RETHKING TRADE & FINANCE (2017) and GLOBAL SURVEY ON TRADE FINANCE (2020) reports are examined, it is understood that the use of the letter of credit payment method has shown a decreasing trend worldwide since 2013.

When we compare the most preferred payment methods in foreign trade by South Korea and Turkey, it can be observed that both countries adhere to almost a single payment method, not considering the risk in import and export.

In this study we conducted on countries’ foreign trade by type of payment methods, no country other than Turkey (Turkish Statistical Institute TUIK) has been identified that publishes this data. In the research, only South Korea's data could be accessed thanks to our Seoul Commercial Counselor.